Poll Results

Participate in Poll, Choose Your Answer.

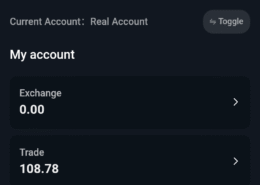

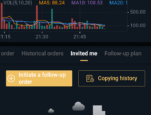

I want to know about BT exchange it’s really platform for crypto

Join our community and gain access to valuable information and insights about scams. Sign up today to be part of a dedicated platform where you can ask questions, share your experiences, and contribute to a safer digital environment.

To ensure the best experience and access all the features of our Platform, please log in or sign up:

Lost your password? Please enter your email address. You will receive a link and will create a new password via email.

Sorry, you do not have permission to ask a question, You must login to ask a question.

Sorry, you do not have permission to add post.

Please briefly explain why you feel this question should be reported.

Please briefly explain why you feel this answer should be reported.

Please briefly explain why you feel this user should be reported.

Scam Alerts

Use the Verify Scams Reporting Platform to Report Scams. It’s Important to Report the scam and Save Others from Getting Scammed.

Enter Website in complete format "https://www.example.com" or "http://www.example.com"

This tool helps you verify the legitimacy and safety of any website.

Scam Alerts

Unlock Premium: Empower Verify Scams Platform, Combat Fraud, Secure Online Spaces. Join Now!

Scam Detection Tools ( Powered by AI)

Scam Text Checker With Screenshot

Scam Reported Email Id Checker

Scam Website Checker

Scammer Ph. No. Checker

Scam Reported Apps Checker

Already Got Scammed?

Do Report the scam and Save Others from Getting Scammed.👍

You can submit reports concerning websites/apps, phone numbers, email IDs, scammer social media accounts, social media posts, deep fake videos, and businesses engaged in fraudulent activities.

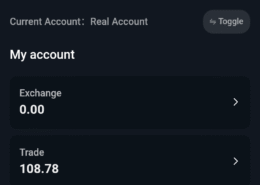

50%BT exchange ( 2 voters )

50%BT exchange ( 2 voters )

50%BT exchange ( 2 voters )

50%BT exchange ( 2 voters )

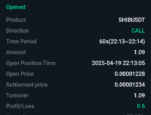

I want to know about BT exchange it’s really platform for crypto

One of the member telegram say pay money for trading and you got huge and they send account no details I also pay but my money is not refund

How do I know if a gaming app is a fake paying gaming app

gofirstpurchasefree.com Sospecho que fui estafado al realizar una compra en una tienda online. Hice un pedido, pero no he recibido el producto ni respuesta del vendedor. ¿Alguien más ha tenido problemas con esta página?

Is tescopro.shop legit company in south africa

Based on a thorough review of available information, tescospro.shop appears to be a scam website. Here's a detailed analysis: ⚠️ Key Warning Signs Negative User Experiences: Users have reported being scammed, such as receiving incorrect items or nothing at all after making purchases. Recent DomaRead more

Based on a thorough review of available information, tescospro.shop appears to be a scam website. Here’s a detailed analysis:

⚠️ Key Warning Signs

Negative User Experiences:

Users have reported being scammed, such as receiving incorrect items or nothing at all after making purchases.

Recent Domain Registration:

The domain was registered on October 11, 2024, making it relatively new—a common trait among scam websites.

Lack of Transparency:

The website provides no verifiable company information, such as a physical address or customer service contact details.

Suspicious Online Activity:

The site has been associated with suspicious online activities, including phishing and malware risks.

🛡️ Recommendations

Avoid Transactions: Do not make any purchases or provide personal information on tescospro.shop.

Report the Site: If you’ve encountered this site, consider reporting it to relevant authorities to help prevent others from falling victim.

Monitor Financial Accounts: If you’ve shared payment information, monitor your accounts for unauthorized transactions and consider contacting your bank.

If you need assistance with reporting the site or recovering from a scam, feel free to ask.

See lessWie überprüfe ich, ob ein verifiziertes telegram konto echt oder fake ist? Ob das verifizierte Zeichen samt Namen gestohken sind?

Hallo, Sie können uns über den Chat-Support. kontaktieren und die Details des Telegram-Kontos mitteilen. Wir werden das überprüfen. Thanks for using verifyscams.com

Hallo, Sie können uns über den Chat-Support. kontaktieren und die Details des Telegram-Kontos mitteilen. Wir werden das überprüfen.

Thanks for using verifyscams.com

See lessDora

Tha united state I R S company in south Africa is given out r90 000 for giveaway to each family in south Africa that’s the message I received

Thanks for sharing that! Based on the message you received — "The United States IRS company in South Africa is giving out R90,000 to each family" — this sounds very suspicious and highly likely to be a scam. Here's why: 🚨 Red Flags: IRS is a U.S. agency – The IRS (Internal Revenue Service) only operRead more

Thanks for sharing that! Based on the message you received — “The United States IRS company in South Africa is giving out R90,000 to each family” — this sounds very suspicious and highly likely to be a scam. Here’s why:

🚨 Red Flags:

IRS is a U.S. agency – The IRS (Internal Revenue Service) only operates in the United States and deals with taxes. It does not give out money to families in other countries like South Africa.

R90,000 giveaway – Scammers often use large amounts of money to lure people in.

Strange wording – “IRS company in South Africa” is not a legitimate term. The IRS is a government agency, not a company, and it doesn’t have official branches in South Africa.

Unsolicited message – If you didn’t apply for anything and suddenly receive a message about a giveaway, it’s a major red flag.

No official verification – These kinds of offers aren’t announced through private messages or SMS. Real government aid would be communicated through official channels.

✅ What You Should Do:

Do not respond.

Do not share any personal information (like ID numbers, bank details, etc.).

Report the message as spam or fraud if received via SMS, WhatsApp, Facebook, etc.

Thanks for using verify Scams Platform.

See less

What about DGQEX-DG I believed it's fake.

What about DGQEX-DG I believed it’s fake.

See less